In What Ways Does Quickbooks Track Sales Tax

Most business owners hear the words "sales tax" and go running for the hills (or to their accountant). Do we blame them? Of course not. While it can be intimidating, there's no need to break into a sprint! I'm going to walk you through the details of setting up sales tax in QuickBooks Online.

Sales tax is a state tax on goods and services sold and varies from place to place. If you're not sure what that rate is for your state, find out here .

Note: Not all customers are required to pay a sales tax. Look and see what qualifies your customer to pay or not , and then you can set them up as tax-exempt if necessary.

Now, where to start?

Double-check your business address . This is important because QuickBooks uses this info to set up the right tax agency and rates for you.

- Go to Taxes on the left menu, and then Sales Tax .

- Select Set up sales tax .

- If you have already set up your business address in Settings, this step should reflect that address. If not, you can add it now.

- Review and click on Next .

Tell QuickBooks if you pay other tax agencies . QuickBooks needs to know this if you sell products outside of your city/county/state since there are different rates for different locales. Note: If you're not sure if you need to or currently file with other tax agencies, reach out to your accountant or tax adviser.

- Select Yes or No .

- If you select Yes , add the other tax agencies you pay.

- When you're done, go to the next step.

Choose your frequency so QuickBooks can remind you when it's time to file. If you're not sure of the date, check your tax agency's website to know your file frequency.

- Select the Filing Frequency drop-down, then choose how often you file.

- Lastly, add the start date and Save .

Just like that, you're all set up. Now the Sales Tax field will show up on your invoices, sales receipts, estimates, and credit memos. While in any of these windows, apply sales tax by following these steps:

- Add your products/services to the form.

- Under the Tax column , check the box under Tax for each taxable item.

- Click in any white space to update the sales form . At the bottom right, select the appropriate sales tax.

If you sell to tax-exempt customers (organizations, non-profits, or charities, to name a few), you can choose to not collect sales tax from them. By default, all customers are "taxable."

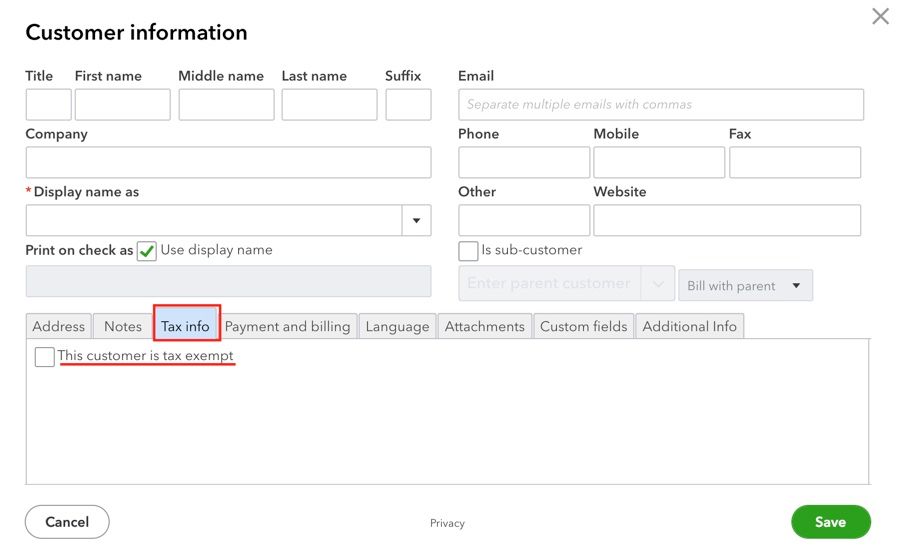

To change this setting, navigate to theInvoices>> Customers tab and edit their account. Find the Tax info tab in the edit window and check the box to exempt their account.

One thing to keep in mind: If you've already charged sales tax on earlier transactions, you won't be able to disable the sales tax feature without first removing the sales tax from older transactions.

There you have it, easy as pie! If you find yourself asking more questions, stay tuned because next week I'll have even more information on sales tax, like reports and other important information you need!

In What Ways Does Quickbooks Track Sales Tax

Source: https://quickbooks.intuit.com/learn-support/articles/getting-the-most-out-of-quickbooks/setting-up-sales-tax-in-quickbooks-online/05/924004

0 Response to "In What Ways Does Quickbooks Track Sales Tax"

Postar um comentário